Why

Adaptive Decision Making?

Success Rate

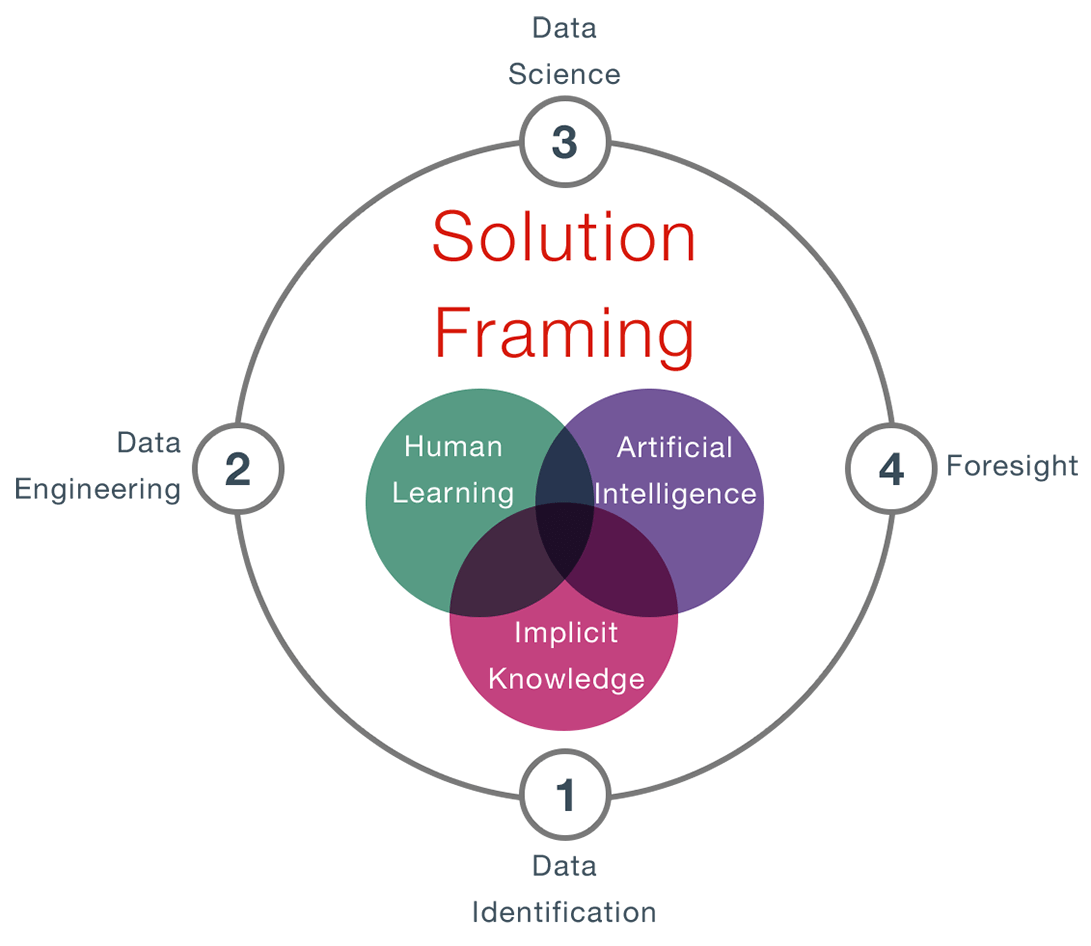

Traditional analytics will not help you differentiate, or truly optimize your business for success.

Are You Searching For A Better Way To Achieve Sustainability? A Measurable System For Rapid Success?

Decision Making

Are You Searching For A Flexible, Adaptable, And Intelligent Decision Making Tool?

Data Analytics

Asking the right question is not enough nor is number-crunching terabytes of data.

Are You Searching For An Analytic Approach That Allows You To Achieve Measurable Success?

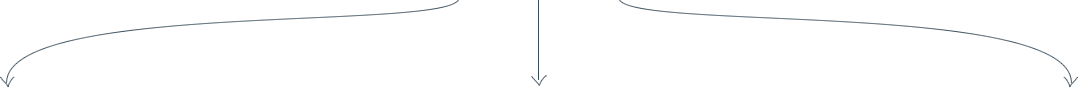

What is Adaptive Decision Making?

Founding Pillars

Analytics Sensors to Increase Your Odds of Winning, Today and Tomorrow

We equip your organization with the analytic sensors that support sustainability in the ever-changing and uncertain world of business.

Human Learning

+

Machine Learning

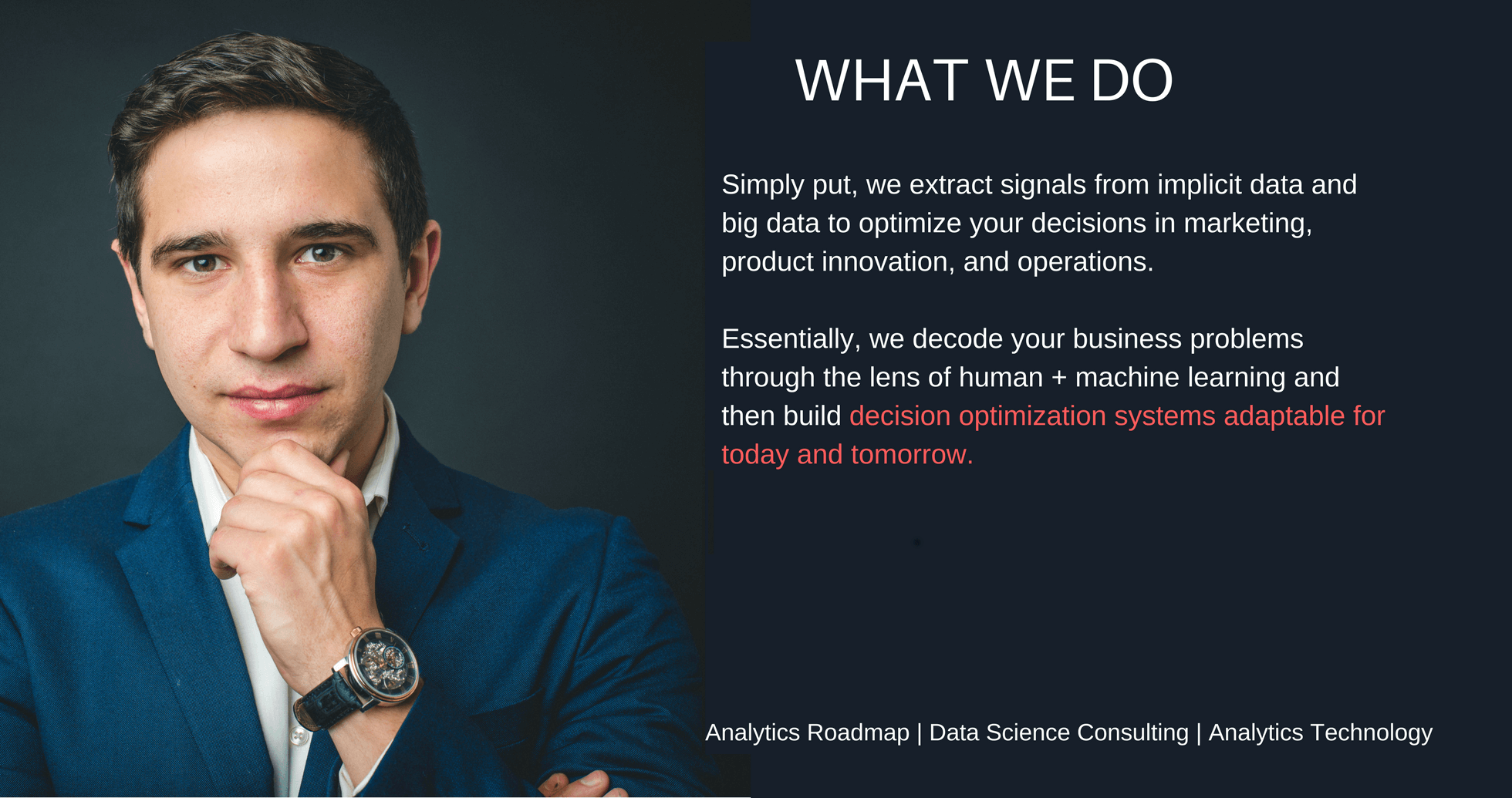

Just being data-driven is simply not enough. Blend intuition, human learning, and machine learning to make sound choices.

Asking The Right Question is not Enough

A structured process designed to generate discriminating knowledge and derive different answers to consistently make major impacts.

We Drive Business Impact Through Our

Decision Engineering Process

Meet Our Decision Engineering Team

Dextroites are passionate about cracking the toughest codes to solve complex problems, and discovering innovative new opportunities. But let's face it, the proof is in the pudding. Here are the numbers that support our success.